We’ve had enough of the bad news all year and I suggest that we start changing the mindset for 2011.

To do this we need two things: we need some good news and we need a plan.

First, the good news. The Australian Bureau of Statistics has just reported that housing finance – mortgages, basically – increased slightly between September and October. The rise was only 2.2 per cent but it’s enough to suggest that Australians are once again committing themselves to the housing market, which is one of the basic measures of Australian economic confidence and household wellbeing.

Also, finance commitments for owner-occupied housing increased 2.8 per cent and the finance of new dwelling increased 9.4 per cent.

We don’t need to dance in the streets about this, but when you see the trend line – and how far and how steeply housing finance plummeted over the past two years – it’s actually a good sign.

It’s good because not only does it mean that there’s confidence in households in general, but here’s a sense of certainty about employment and income.

When Australians are prepared to go into long term debt again, it means hey believe in the future.

It’s good news also for the banks: while many banking systems around the world are stagnant or diffident or simply trying to shut-out households from the mortgage market, the Australian system at least looks as though it wants to be back in the game.

It’s a good sign because it means that banks, credit unions, building societies and non-banks lenders are all assessing property as a good bet and the economy as sustaining high employment.

Add to that the fact that property prices in the major cities have at least held their ground over the past 12 months and we may have something to laugh about in 2011.

But you must a have a plan.

I think a good approach is to use the holidays as a time when you stop fretting about all the details and instead let your mind deal with some of the bigger ideas. For instance, if the banks are lending mortgages then property could be part of your plan in 2011.

Maybe you have an idea about shares, or about refinancing your house and doing renovations?

But have a plan.

Most important, remember that economic news reminds us that what we call the economy is actually all of us making decisions about buying, selling and saving.

How you want to be represented in this economy is up to you. you can drift along, being scared off by the headlines and the pessimists. Or you can look for the positive signs and make a go of it.

It all starts with a plan.

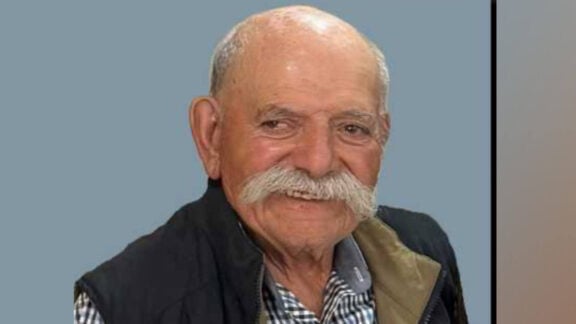

Mark Bouris is the Executive Chairman of Yellow Brick Road, a financial services company offering home loans, financial planning, accounting & tax and insurance. Email Mark on mark.neos@ybr.com.au with any queries you may have or check www.ybr.com.au for your nearest branch.