This week has seen some incredible fluctuations in the markets and a real divergence of opinion among economists, analysts and commentators.

Essentially, the sovereign debt problems of Greece, Italy and the United States grew so huge that the markets held their breath. And when Standard & Poors downgraded the US credit rating last week I believe it started a stampede, not necessarily on the fundamentals, but as a reaction to a lot of pent-up apprehension.

For most people, the situation now comes down to two questions: what is going to happen? And, what does it mean for me?

The answer to the first question lies in what the markets are already predicting for the price of money in ten months time.

The current chart for the Sydney Futures Exchange Interbank Futures Contract shows a steeply descending line, implying a Reserve Bank cash rate of around 4 per cent in May-June of next year.

The markets aren’t always right, but when they’re wrong it’s not by much.

In step with this, Commonwealth, Westpac, St. George and ING Direct all cut their fixed rate mortgages last week. And on Thursday, the unemployment rate for July showed 5.1 per cent, up from 4.9 per cent in June.

So Reserve Bank governor Glenn Stevens has plenty of ammunition for a rate cut.

I think the Reserve should reduce rates, and my company Yellow Brick Road has been arguing for several weeks that the current 4.75 per cent official rate has been too high.

The second question is how does this affect me? If you have a mortgage, do you switch to a low-rate fixed loan? Or do you assume that the markets have got it right, and that Australia’s economic strength is going to wane for the better part of a year and interest rates will fall anyway?

Fixed gives you certainty, but it doesn’t give you the best market rate in any given month, as the variable rate does.

Variable puts you with the market; fixed makes you bet against it.

One way forward is to split your loan: half fixed – half variable.

My overall comment is that people should meet uncertain times with good advice. If you are nervous about what to do with a home loan, see a mortgage broker, a financial planner or your accountant. This is no time to be swayed by pub chatter and barbecue gurus – see someone with a professional affiliation who is duty-bound to tailor a solution to your needs.

We’re facing troubled times, but there’s not much you can do about it except protect yourself by getting good advice.

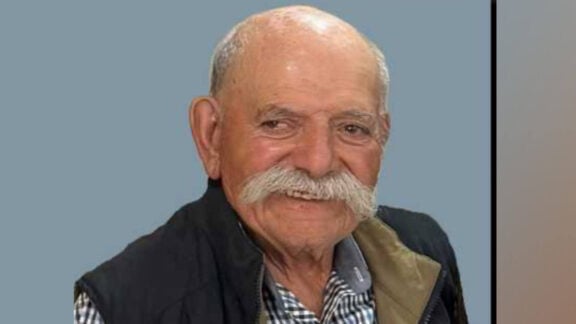

Mark Bouris is the Executive Chairman of Yellow Brick Road, a financial services company offering home loans, financial planning, accounting & tax and insurance. Email Mark on mark.neos@ybr.com.au with any queries you may have or check www.ybr.com.au for your nearest branch.