Property is on people’s minds again – the holidays are over and it’s time to get serious about what you’re doing with real estate this year.

Here are a few facts. Property peaked in May 2007 when it was growing at 4.0 per cent per year, but by early 2008, property value growth had hit zero and was heading south to -1. and -1.5 per cent, where it stayed for a year.

Prices recovered in 2009 to around 3.0 per cent growth, but then dipped later in the year. Then, in the year to November 2011, prices were negative again.

When you look at this story on a graph, it looks like an ‘S’ lying on its side: up and down, not knowing where to go.

Now, in the most recent RP-Data Rismark release from two weeks ago, there’s a sign of recovery. Capital city sales in November showed a gain of 0.1 per cent and regional/non-capital city property sales rose by 0.3 per cent.

The growth might be small, but the good news is that it’s now heading in the right direction.

To bolster this scenario, interest rates were cut in November and December, bringing the official or cash rate to 4.25 per cent, which puts a variable rate mortgage in a comfort zone for most borrowers.

Confusion usually reins in property when too many people treat it as a short term asset. It’s not: property is a steady, 10-year asset that you can also live in and there has not been a decade since the end of World War II where property values have not risen.

With this outlook the worst thing you can do is stay out of property too long.

If you can’t buy what you want, you can buy an investment property and go renting where you want to live. If you’re handy you can buy a place that needs work, and get into the market in that way. Some people go in with a friend, or with a parent.

However, the important rules with property are these: don’t over pay; don’t borrow too much; and buy where there’s schools, hospitals, public transport routes, recreation grounds and parks. These are the things that will support an area’s value.

I would add one last thing. Don’t become dependent on what interest rates will do and make a move into the market if you can comfortable afford the repayments. There are never any guarantees but if you buy on the basics and don’t over pay, property is a good bet… as long as you see it as a 10-year investment.

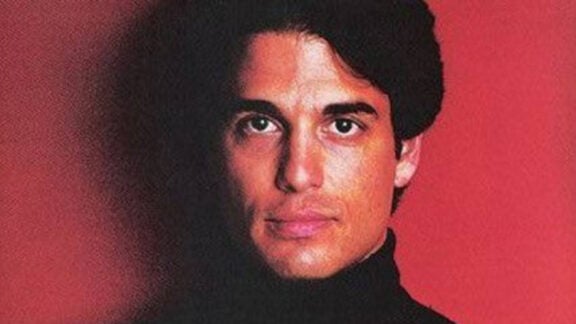

*Mark Bouris is the Executive Chairman of Yellow Brick Road, a financial services company offering home loans, financial planning, accounting & tax and insurance. Email Mark on mark.neos@ybr.com.au with any queries you may have or check www.ybr.com.au for your nearest branch.