Activity in the Australian construction sector has now contracted for 19 consecutive months according to an industry survey released last week. The monthly Australian Industry Group/Housing Industry Association Performance of Construction Index (PCI) rose 1.4 points in December to 41. A figure below 50 shows that the industry is contracting, while a figure above indicates expansion.

The commercial, apartment and engineering construction sectors saw improved scores in the latest report, but housing construction continued to shrink with a reading of 32.9, down from 38.6 in November.

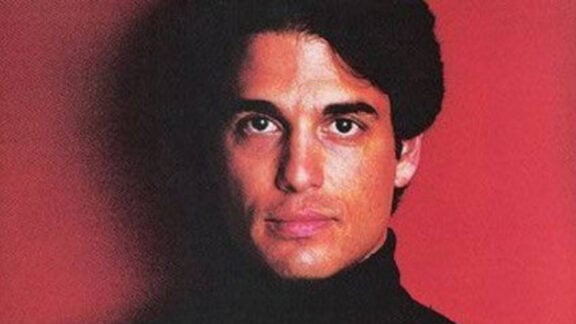

The Federal Reserve Bank’s decision to cut interest rates twice at the end of 2011 has done little to support the industry, says Michael Argyrou, Managing Director of The Hickory Group.

“Reserve Bank rate cuts aren’t really flowing through to the investors, and that’s because the banks aren’t necessarily dropping the interest rates that they’re charging. “Property developers are paying more for their development funding not less. That cost of money has gone up significantly, well over 10 per cent now, and that makes developments less likely to get up.”

Argyrou points out that with Australian banks dependent on overseas credit for investment capital, “the cost of money is going up not down.” “Banks are also not feeling confident to finance property developers, because they’re taking the view that the market is either oversupplied or in decline, so they’re making it much more difficult for developers to borrow money,” says Argyrou, whose company has constructed more than $1 billion worth of projects.

“We’re finding tendering opportunities are drying up really quickly, so we’re working harder to sign projects up. We’re taking a view that there’s going to be a lot less work around shortly.” Despite apartment building recording its slowest decline in five months with a lift of 9.9 points to 33.3 in the latest PCI report, Argyrou predicts that 2012 is likely to see a further deterioration in activity. “In the apartment market, the last deals for some time will be done in the next six months. For the final six months of 2012, I think there will be few, if any deals to be done.”

Housing Industry Association Chief Economist, Harley Dale said this week, that continuing contraction in the construction sector showed that there was “a clear need not only for further interest rate relief but also for government action in terms of both shorter-term stimulatory measures and a re-invigorated plan for policy reform”.