A week after talks between Greece and its creditors, hit an impasse, the two sides remain bogged down over the interest payment or coupon the country must offer on its new bonds.

The Greek state and its bondholders have made little progress since resuming talks on a debt swap, with time to strike a deal and avoid a messy default, running out rapidly.

According to Reuters, sources close to the talks say the Greek government and its foreign lenders offered a coupon of just over 3.5 per cent during a two-hour meeting mid-week, but bondholders rejected that as too low. They were angling for a coupon of at least 4 percent according to the same source.

A senior government official also played down speculation that terms of a deal had been nearly pinned down, saying: “Nothing has been concluded yet.”

One banker briefed on the talks, said progress was made on minor points related to the structure of the deal, and the law it would fall under, but that the coupon remained a sticking point. Still, a deal could come together soon, the source said.

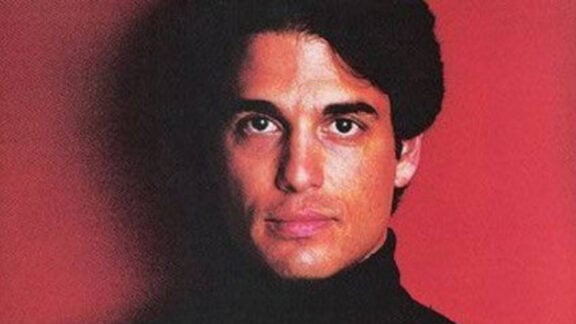

“This is not to say that a deal cannot be concluded in the next three days – there may be developments by Monday or Tuesday,” the banker said. Negotiations between Prime Minister Lucas Papademos and Charles Dallara, head of the International Institute of Finance lobby representing private bond holders, were due to resume in Athens on Friday.

The stakes could not be higher. The two sides must thrash out a deal within days to pave the way for the country to receive a new infusion of aid and avoid bankruptcy, when 14.5 billion euros of bond redemptions fall due in March. Even if a deal is struck rapidly, the paperwork will take weeks and the state’s official lenders – the European Union and the International Monetary Fund – say the work must be cleared before funds are doled out from a 130 billion euro rescue plan they drew up in October.

Turning up the pressure ahead of Friday’s talks, Finance Minister Evangelos Venizelos told lawmakers that a large chunk of the bond swap must be agreed by noon on Friday and formalised before Monday’s meeting of eurozone finance ministers.

“Now is the crucial moment in the final battle for the debt swap and the crucial moment in the final and definitive battle for the new bailout,” Venizelos told parliament. “Now, now! Now is the time to negotiate for the sake of the country.”

No miracles

The swap is aimed at cutting 100 billion euros off the country’s 350 billion euro debt load by getting the private holders of state bonds to accept a 50 per cent write-down on their notional value.

But terms of the swap – including the interest rate and maturity date of new bonds Greece would sell to the private creditors in place of old debt – have been up for negotiation.

The talks ran into trouble last week over Greek demands for an interest rate below the 4 per cent that banks were willing to stomach and a plan to enforce losses on investors.

A lower interest rate would push the actual loss investors take, to well above the 50 per cent level initially envisaged.

Meanwhile, the governor of the central Bank of Greece made a more urgent appeal to his countrymen and their leaders to implement reforms or risk being pushed into an ignominious eurozone exit.

“If we ignore reality this time, the outcome will be a given: the country will become economically and politically isolated,” George Provopoulos said.

In Washington, an IMF spokeswoman said staff at the Fund had sought executive board approval for talks with Greece that might lead to a deal requiring “exceptional access” to IMF loans.

Greece already has exceptional access to IMF funding that allows it to draw more than 600 per cent of its IMF quota and any further negotiations require fresh board approval.