A business owner’s failure to separate themselves from the business entity is one of the biggest problems I see in small and medium sized enterprises.

Total absorption in your business may feel necessary at times but living like this affects financial performance as much as mental health.

Business owners are at their most efficient when they create and maintain a sort of critical distance from their business. Here are a few tips on how to do this:

Goals: when starting or buying a business, write down why you are doing it, what you want to get out of it and what will define ‘success’. You have to know the goal.

Structure: separating the person from the business starts with structuring. Are you a company, a sole trader, a partnership, a trust? You should engage a solicitor and accountant before starting a business, and have the ramifications spelled out to you in terms of tax, equity, liability law, business sale, superannuation and a host of compliance issues.

Exit: smart business owners don’t ‘love’ their enterprise too much; they grow it like a crop and ensure they have a capital gain when they sell. This requires a clear division in your mind between yourself and your business. It also requires you have a system…

System: the separation of business and business owner often comes down to the creation of a system for creating revenues as opposed to simply having a hard-working owner at the helm. This not only makes your business more valuable to buyers and more reliable in the eyes of the banks, but it helps you become a more successful business owner. With systemised management structure, financial reporting, sales functions and client contracts etc, you have the opportunity to work on the business rather than simply in it.

Liability: separating yourself from the business requires correct structuring, so that the legal/financial liabilities of the business are not sitting on the shoulders of you and your family.

Protection: You need the right insurances not only for the business, but for you. You need insurance cover for your family, and also for your business: if you have staff, some sort of key person/business continuance cover is essential to ensure they are looked after. And if you have a family company, and you’re the major shareholder, what is your continuance strategy and is it in your will?

Experts: the best way to ensure personal/business separation is to engage the right experts at the right time. External professionals focus on the issue and they chase results, which gives you – the owner – the chance to see the business through clear eyes, untainted by history, personalities or emotions.

What’s in it for me? You’re the one who works like a maniac, who loses their weekends and goes over the spreadsheets late into the night. You must have your reward. Whether you structure this as a salary, bonus or a dividend, you must be rewarded by the business. Your business doesn’t own you – you own the business.

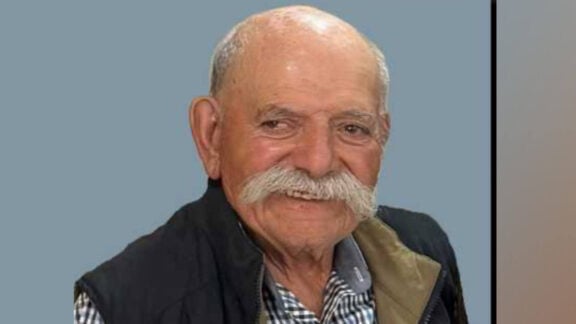

* Mark Bouris is the Executive Chairman of Yellow Brick Road, a financial services company offering home loans, financial planning, accounting & tax and insurance. Email Mark on mark.neos@ybr.com.au with any queries you may have or check www.ybr.com.au for your nearest branch.

Advertisement

Separation of powers

A business owner’s failure to separate themselves from the business entity is one of the biggest problems I see in small and medium sized enterprises, writes Mark Bouris