With inflation coming in lower than expected on Wednesday, speculation has mounted that we could see another rate cut as soon as February.

But will it actually happen?

With the slight rise in consumer prices in the December quarter, inflation now sits at 2.2 per cent, which is within the RBA and the Treasury’s target of 2-3 per cent. With inflation contained, the RBA has room to cut rates further off the back of the October and December rate reductions. The question is: does the RBA believe the economy is tracking well enough to leave rates where they are, or do we need another cut to ease some of the pressure?

A rate cut is a possibility, and many economists are predicting the official cash rate will drop to as low as 2 per cent in 2013. So whilst a cut might not come as soon as February, it’s worth looking at what’s in store for mortgage holders and savers if the RBA drops rates again.

If you’re a home owner with a variable rate mortgage, a rate cut would be music to your ears. It means lower monthly repayments, or if you’re one of those savvy borrowers who keep your repayments steady when rates drop, you’ll be on the fast track to shortening the life of your loan.

A rate cut has other positive repercussions: it gives the lending market a good rev up with regards to competition. When the RBA announces a rate cut, the big question inevitably becomes, “Will my bank pass on the whole lot?” As we’ve seen in recent months, lenders are no longer mirroring the Reserve Bank’s decision, and that makes borrowers take a closer look at their own home loan rates to make sure what they’re paying is competitive. That’s a good thing – it tells us that people are educating themselves, looking closely at their options and taking action to get a better deal. That kind of consumer behaviour pushes lenders to offer better rates in order to compete with one another.

So whilst a rate cut is good news for home owners, it’s a different story for savers. When interest rates go down, so do deposit rates. So if you have money in the bank, it’s very likely you’ll be earning a lower rate of return.

According to the RBA, the average online savings account rate is currently just 3.05 per cent. The average term deposit rate is just 3.45 per cent. This means that after accounting for cost of living changes, deposits are not offering savers much, if any, real return.

So how can people with money on deposit protect themselves against falling rates? Just like home owners, savers should be shopping around. Comparison web sites such as RateCity.com.au, Mozo.com.au and Canstar.com.au evaluate products like for like, so you can see who’s offering the best returns. The key is to be proactive and do the research. There are options out there that are still offering good, solid returns.

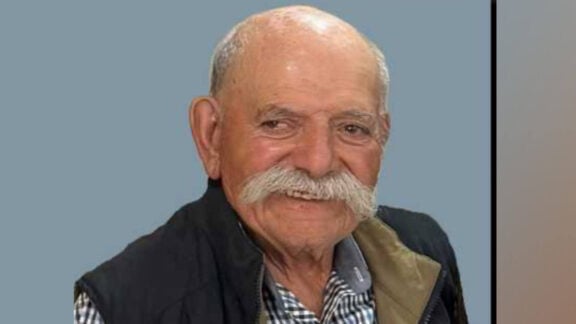

* Mark Bouris is the Executive Chairman of Yellow Brick Road, a financial services company offering home loans, financial planning, accounting & tax and insurance. Email Mark on mark.neos@ybr.com.au with any queries you may have or check www.ybr.com.au for your nearest branch.

Advertisement

Is a February rate cut on the cards?

With inflation coming in lower than expected on Wednesday, speculation has mounted that we could see another rate cut as soon as February