Australia’s craft beer industry is no longer thriving as it once was, and is at the risk of collapse.

As reported by news.com.au, independent brewers are facing a “perfect storm” of obstacles and are at a risk of mass closures.

From multi-million-dollar foreign companies buying out breweries, to lack of government support with tax leaving huge dents in profits, to tap contracts and rising input costs.

Government tax is said to account for up to a third of the cost of beer.

2024 has already seen Sydney brewer Wayward Brewing enter voluntary administration, owing around $2 million to trade creditors, statutory creditors and shareholders, and Independent Brewers Association fears they won’t be the only ones.

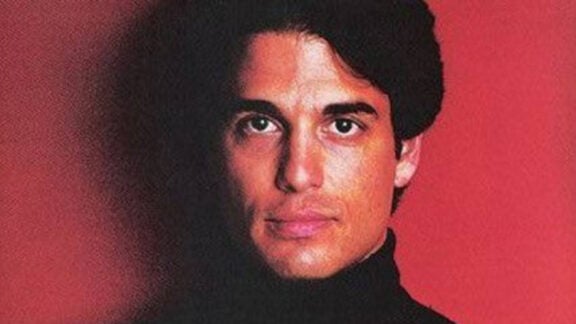

This news has shocked the industry with co-founder of Sydney based Philter Brewing, Stef Constantoulas saying that change is critically needed.

“When good Australian businesses that have been in business for a long time, are starting to diverge on administration and problems, there’s something fundamentally wrong,” he told news.com.au.

“There’s something wrong with a system and how it’s run when good businesses like that, popular brands, are being forced to go under.”

He said the industry is stuck in a constant grind against these market forces.

“I don’t think there’s any lie that it’s a pretty tough trading environment for independent craft breweries at the moment.”

“The number of friends of ours, unfortunately, hitting the administration button or losing their businesses is pretty shocking to see.

“We are in an industry where we are a premium on a premium.”

As mentioned earlier, government tax is hitting breweries hard and it won’t stop with Australia’s excise tax on alcohol set to increase every six months.

In the 2021-22 federal budget, the government announced a $225 million tax relief for small breweries and distillers, but the current tax is being said to contradict that.

“We’re just not getting the support we need at a government level or at an overall industry to help us remain more competitive,” Constantoulas said.

“Excise tax is the biggest gripe we have as an industry. We pay the same amount of excise that Lion or CUB do.”

He said that with the excise rising every six months, so will the prices of beer, and that “it’s also very hard for a consumer to understand why their beer is getting more expensive.”

Some of nation’s most well-known beer brands are no longer owned by Australian companies, with Japanese food and beverage giant Asahi now owning Carlton, United Breweries, VB and Great Northern.

The $29 billion company also acquired a number of highly-acclaimed former craft breweries including 4 Pines, Balter Brewing, Green Beacon, Mountain Goat, Pirate Life, Matilda Bay and Yak Brewing.

Constantoulas said he and most others do not criticise those who sell their brand to the international corporate companies.

“You can’t begrudge the guys who sold – it’s almost like winning the lottery, you know, in terms of the money that gets paid for these craft breweries,” he said.

“I think the shame for us as an industry as a whole is we lose very important players, because the ones getting bought are obviously quite large – we almost lose a big chunk of our voice when that happens.

“Craft, by definition, is independently owned.”

He also revealed that Philter has had large companies approach them looking to buy, so in response they launched an equity crowd-funding campaign in October last year, netting over $2m from more than 1200 investors.

They didn’t want to give away their business and lose control, and now with 1200 new investors they plan to double their brewing capacity to 2.5 million litres.