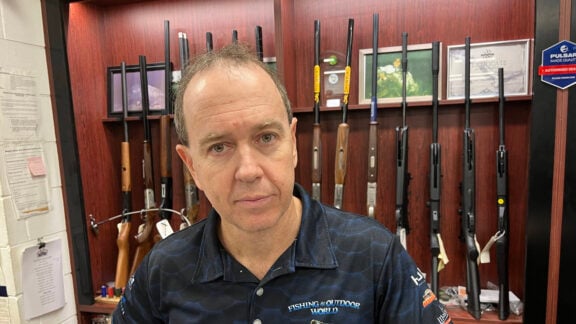

David Catsoulis, a twice-bankrupt mining promoter, continues to tout his Papua New Guinea gold project, despite mounting legal issues for his company, Impact Gold.

The company is currently facing a winding-up application, alongside a claim for damages against Catsoulis personally.

Impact Gold has been advesrtising its gold project in PNG’s Maprik region for nearly five years, with investor documents from 2019 estimating a conservative 35,000kg gold resource.

However, no substantial evidence under Australian mining standards supports this claim, nor has significant gold been mined, The Advertiser reported.

In a recent letter to investors ahead of an upcoming AGM on June 28, Catsoulis announced anticipated new investment of $25 million from Melbourne’s Australian Refining Services (ARS).

ARS director John Spiteri stated that his investment is contingent on completing due diligence, dismissing criticisms as a “witch hunt.”

“My investment will only happen when my due diligence is done … I’m very convinced that the gold is there. I think you need to get your facts right because I think you’ve got the wrong facts,” Spiteri said.

The company has appointed a new CEO, initiated a joint venture with a Chinese firm, and begun acquiring heavy equipment for major earthworks.

A key goal for the new CEO is to produce over 1000kg of gold in the initial three months, valued at more than $120 million at current prices.

Meanwhile, Impact Gold faces a winding-up application in the Queensland Supreme Court from Port Barrack, citing “unpaid dividends and contractual obligations”.

Moreover, a related Supreme Court claim seeks $755,000 in damages from Catsoulis and his company Catimel, alleging unfulfilled promises regarding share investments.

Catsoulis defended himself, noting he advised the investor behind Port Barrack against investing due to concerns about the investor’s age and health.

“He was old and frail, and I am on record saying this to him,” Catsoulis wrote.

The winding-up application is set for a directions hearing on July 9.

Another venture of Catsoulis, Warwick Gold, previously claimed to hold over $2 trillion in precious metals at its Texas project, but was liquidated in February.