When you mention that you’re nearing retirement, the first question often asked is, ‘Do you have enough?’ Enough accumulated savings? Enough superannuation contributions and financial resources?

We’re constantly reminded that financial preparedness is crucial to maintaining our lifestyle. But how prepared are we for navigating a retirement lifestyle mindset?

A search for a retirement planning checklist predominately points to financial preparedness and seeking financial advice. And rightly so. The financial aspect is particularly relevant for Australian midlife women who will represent 54 per cent of the 226,000 retirees in the next two years.

Midlife women’s capacity to accumulate a sizable nest egg is often compromised by roadblocks throughout their working life.

This financial insecurity leading to a smaller superannuation contribution may result from women’s wages being lower than men’s, prioritising their spouse or partner’s career advancement, interrupted employment patterns because of childcare responsibilities, disadvantaged promotion opportunities periods of family leave and changes in spousal or partner relationships.

The fracturing of family and community ties among midlife women, particularly those from diverse ethnic backgrounds, often leads to significant lifestyle changes, including the loss of cultural identity and social standing. This, in turn, can make the transition from employment to retirement even more challenging.

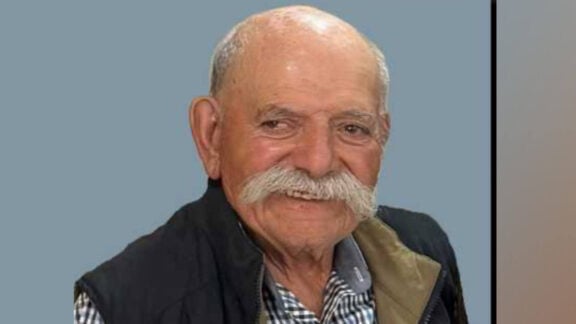

Increased longevity and the trend of having children later in life often place midlife Greek Australian women in a dual role, managing intergenerational stress while meeting the expectations of both adult children and elderly parents. These women, who have traditionally shouldered the responsibilities of child-rearing and caring for aging parents, are particularly affected by this dual burden.

Retirement marks the beginning of a new life stage, where broader lifestyle changes come into play. Hobbies, social connections, part-time jobs, and volunteering may replace the job security of earlier years, all within a lifestyle mindset that extends beyond just financial preparation. This then begs the question should retirement preparedness checklists also emphasise readiness for a lifestyle mindset?

Australian women seem to think so. While ensuring financial security was indeed viewed as critical for midlife women across different socio-economic groups, cultivating the right mindset emerged as an important and common thread. Harbouring preconceived notions or failing to explore retirement in-depth can create barriers that hinder progress toward a successful retirement. Midlife women who engaged in lifestyle preparation for retirement demonstrated more confidence, self-empowerment and acceptance of this transition in life. This contrasted with a ‘will do when ready’ mindset of deliberate procrastinating about making methodical plans for retirement and potentially missing out on beneficial retirement options.

So, what can be done to broaden the checklist for retirement preparedness in addressing lifestyle mindset?

The ball is in the financial service industry’s court. The finance sector should consider incorporating strategies to overcome mindset barriers as a critical component of their financial product and service retirement offerings. Make self-reflection and awareness of lifestyle goals part of seeking financial planning advice and stay informed.

Add to this how to maintain social capital through supportive networks and connections. Set about customising retirement offerings by listening to avoid a one-size-fits-all approach, especially so for targeting midlife women of diverse ethnic backgrounds who have experienced changes in their relationship status.

Retirement preparedness can be truly all-encompassing. However, starting by including both financial security and a lifestyle mindset in your retirement checklist is an empowering first step.

Dr Foula. Z. Kopanidis FHEA – is an Associate Professor of Marketing at RMIT University.