At least 12 Greek Australians have been named in The Australian’s rich list, a ranking of the nation’s 250 richest people in 2024.

Some of the revealing insights from the biggest annual study of the wealthy and successful show that this year’s list includes 159 billionaires (up from 139 last year), 23 newcomers, and 20 people aged 40 and younger.

Meanwhile the average age of members is 64, property had more people than any other sector and almost 45 per cent of the richest Australians reside in NSW.

The combined wealth of the ‘250’ also rose to a new high of $591.31 billion, up from $531.96bn in 2023.

Unsurprisingly, Gina Rinehart, Hancock Prospecting came in first with a value of $50.48 bn. She was followed by the combined wealth of Andrew and Nicola Forrest of Fortescue Metals Group & Tattarang Capital ($37.17 bn), Anthony Pratt & Family, Visy & Pratt Industries ($27.66 bn) and Harry Trigulboff, Meriton ($26.01 bn).

Rounding out the rest of the top 10 is Atlassian’s Mike Cannon-Brookes ($22.92bn) and Scott Farquhar ($22.65bn), politician and businessman Clive Palmer ($21.92bn), chairman of Seven West Media Kerry Stokes ($11.01bn).

From Canva, Cliff Obrecht and Melanie Perkins took out 10 and 11 with a combined worth of $10.92bn.

Below are the Greek Australians who made the list (there may be more with Greek heritage but this list includes those with Greek names).

60 – Nick Politis, WFM Motors & Eagers Automotive ($2.42bn)

This year Nick Politis celebrates 50 years since he bought the City Ford dealership in Sydney, from which he built Australia’s largest vehicle retail empire.

He is the chairman of the Sydney Roosters in the NRL and is also responsible for the first sponsorship on a professional rugby league team’s jersey.

After immigrating from Greece as a child, Politis rose through the ranks at Ford headquarters before quitting because he was not allowed to buy a dealership and work as an executive at the same time.

In 1974 he bought WFM Motors near Sydney’s CBD, rebranded as City Ford and launched an advertising campaign that included sponsorship of his beloved team the Roosters, a relationship that continues to this day.

Politis’ ’empire’ now includes a majority stake in ASX-listed Eagers Automotive and the estate through WFM Motors, which also includes extensive commercial property holdings.

88 – Dennis Bastas, DBG Health ($1.63bn)

Dennis Bastas, the son of Greek immigrants who came to Australia in the early 1960s, quietly brokered a massive $1 billion private debt deal to merge Arrotex Pharmaceuticals with Juno Pharmaceuticals last year, forming the DBG Health.

He previously owned half of both companies – with Canadian investors – but now owns all of DBG Health, Australia’s largest generic drug maker.

He is rising in the list of the richest people in the country.

90 & 91 – Arthur & Terry Tzaneros, ACFS Logistics & AGS World Transport, ($1.60bn combined)

ACFS Port Logistics is Australia’s largest private container logistics company. It was started by Terry and his son Arthur in 2005.

The company currently employs more than 1,500 people across Australia and New Zealand, and the Tzaneros family also owns AGS World Transport, a provider of freight services founded in 1985.

The family’s name has been in the media several times in recent years for its high-profile property investment moves, with Arthur named as the buyer of the $61.5 million Bellevue Hill mansion in Sydney last June.

99 – Nick Andrianakos & Family, Milemaker Petroleum & Nikos Property ($1.51bn)

The Andrianakos family fortune started in the fuel business, but in recent years has grown through a series of real estate investments.

The family business, now led by Theo Andrianakos, paid $134.5m last year for 50 per cent of Melbourne’s Broadmeadows Central Shopping Centre – almost the same amount it paid for half of Adelaide’s Colonnades shopping centre in 2022.

Arriving in Melbourne from Greece in 1966, Nick Andrianakos bought his first petrol station in 1973, going on to build the Milemaker chain from the ground up, which he sold to Caltex in 2016 to the tune of $94mn.

130 – Theo Karedis, Theo’s Liquor & Arkadia Property Group ($1.18 bn)

Much of the Karedis family fortune is now in real estate, including a portfolio Theo Karedis owns with another billionaire family, the Laundys.

Last year, the two families paid $192 million for the Sheraton Grand Mirage Resort on the Gold Coast, adding it to other properties such as Sofitel Noosa and Crown Towers on NSW’s Central Coast.

Theo made his initial fortune from the Theo’s Liquor chain, which was sold to Coles for around $200 million in late 2002.

With 25 retail and commercial properties across Australia, its holdings are primarily large-scale malls specialising in retail tenancies.

133 – Nicholas Paspaley & Family, Paspaley Group of Companies ($1.15bn)

The name Paspaley is synonymous with pearls in Australia, with its roots in the pearl industry dating back to Nicholas Paspaley Sr’s diving trips to the remote shores of Western Australia after his arrival from Kastellorizo in 1919.

The business has since expanded to aviation, retail, livestock, winemaking and commercial property industries among others.

Nick Paspaley Jr is executive chairman and his sisters Marilynne Paspaley and Roslynne Bracher are directors and shareholders of the company.

172 – Spiros Alysandratos, Consolidated Travel ($854m)

After starting Consolidated Travel in 1967, Sprios Alysandratos’ business soon became one of the largest organisations in the travel industry.

Facilitating ticketing requirements for travel agents on behalf of more than 250 airlines worldwide, Consolidated Travel is Australia’s largest private provider of aviation products and services.

Alysandratos’ investment portfolio also includes several commercial buildings in Melbourne’s CBD.

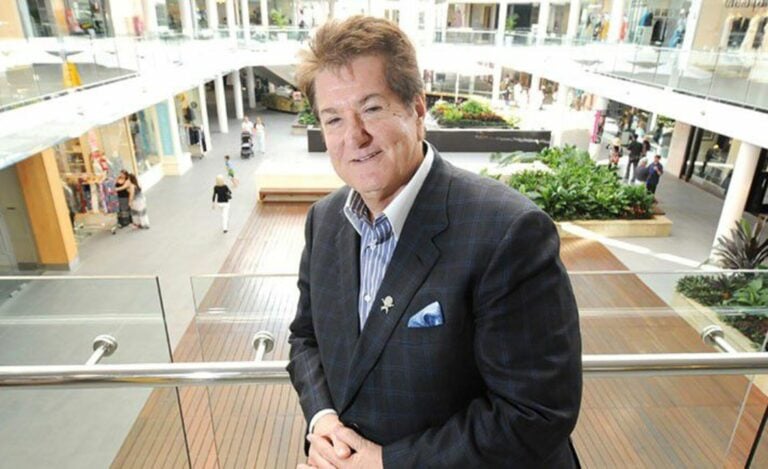

177 – Con Makris & Family, Makris Group ($815m)

The Makris family business is moving ahead with plans for a $500 million transformation of the Marina Mirage area on the Gold Coast’s Main Beach, where it plans to build residences and villas and a 110-room boutique hotel-resort.

Con Makris has focused on the Gold Coast in recent years, having made his fortune in Adelaide.

He had arrived to Australia from Greece at the age of 16 and got his start in the form of a series of real estate acquisitions while operating a number of takeaway chicken shops.

He then began buying real estate and expanded into retail holdings and shopping centres, including in Melbourne.

186 – Harry Stamoulis & Family, Stamoulis Property Group ($785m)

Based in Victoria, the growth of the Stamoulis family fortune can be traced back to the Gold Medal drinks business founded by the late Spiros Stamoulis in 1969.

With the profits of that venture strategically invested in real estate over the years, Gold Medal was sold to Cadbury Schweppes in 2004.

Today, most of the family’s wealth is based on properties it owns in Melbourne, although last year it began expanding on the Gold Coast, with apartments on Main Beach (the project is called ‘ARI’). The Stamoulis family bought an office building near Melbourne’s CBD last year for $155 million.

220 – Kerry Harmanis, Jubilee Mines ($677m)

Former lawyer Kerry Harmanis made his fortune from the sale of Jubilee Mines to Anglo-Swiss multinational mining company Xstrata for $3.1bn in 2007.

He also founded Mindful Meditation Australia to help teachers educate children about meditation and mindfulness.

Since then he’s reportedly kept a low profile, investing in several emergent mining firms. Namely precious metal exploration company Talisman Mining, for which he serves as chair.

233 – Ilias Pavlopoulos, ColCap ($621m combined with Andrew Chepul)

Ilias Pavlopoulos with his brother in-law Andrew Chepul, helm one of the country’s largest non-bank lenders, ColCap.

Founded in 2006, the company has a loan portfolio in excess of $14 billion, $20 billion RMBS aggregate value, and employs over 300 staff in Australia and Philippines.

The group includes Origin Mortgage Management Services, Homestar Finance and Granite Home Loans.