Tony Anamourlis

Dialogue –

Balancing the books or playing politics? Labor’s tax cuts and the future of economic fairness

As Australia heads into another election cycle, the Albanese Government’s proposed income tax cuts have become a contested issue. Framed by Labor as a necessary response to mounting cost-of-living pressures, …

Dialogue –

Beware: A Victorian ruling that could expose your home to land tax if you mix business with living

Navigating the delicate balance between using your home as a personal residence and as a place of business is increasingly challenging. A Victorian State Revenue Ruling, known as LTA.001 (version …

Dialogue –

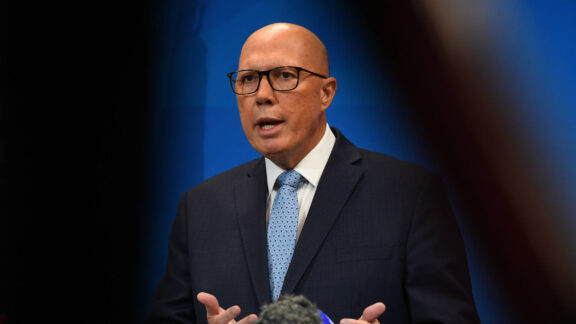

Dutton’s fuel excise cut: A populist lifeline or a fiscal time bomb?

Peter Dutton’s proposal to halve the petrol excise for 12 months is a bold, populist manoeuvre in the Liberals’ armoury as we head for the Federal elections of May 3. …

Dialogue –

Victoria’s soft bail laws: A call for urgent reform to protect victims

Victoria’s bail system is failing its most vulnerable: the victims of violent crime. While offenders benefit from legal protections that prioritise their right to bail, victims are left to deal …

Inheritance tax in Australia: Necessary reform or a political third rail?

The proposal to reintroduce an inheritance tax in Australia is reigniting an old debate one that is often clouded by political fearmongering and ideological divisions. While Great Britain and the …

Dialogue –

Major changes for Aussie property sellers: Clearance certificates now required

From January 1, 2025, if you are selling any type of property in Australia and fail to present a clearance certificate, the buyer must withhold 15 per cent of the …

Dialogue –

Australia’s epidemic of elder abuse in estate planning

Australia stands on the brink of a significant demographic shift. By 2050, it’s anticipated that one in four Australians will be over the age of 65, marking a profound transformation …

Dialogue –

Tax repreive for more holiday home owners flagged under new proposed Victorian bill

The Victorian Government’s introduction of the State Tax Amendment Bill 2024 marks a significant shift in the landscape of property taxation. This bill, if passed, aims to broaden the holiday …

Dialogue –

2024 Federal Budget: Examining key tax measures and their implications

The 2024 Federal Budget introduces a variety of tax measures aimed at stimulating the economy and ensuring fair tax contributions. This article will explore these key measures, highlighting their benefits …

Dialogue –

New property levy on Mornington Peninsula aims to tackle housing crisis

New Property Levy on Mornington Peninsula Aims to Tackle Housing Crisis The Mornington Peninsula Shire, encompassing affluent areas such as Portsea, Sorrento, and Flinders, is setting a bold precedent with …