The end of this financial year may bring on one of the most confusing tax times yet.

Many employees have purchased new equipment and are relying on their home and mobile phones, internet and power as coronavirus restrictions have moved them into their homes for work.

Businesses have also been making major changes to keep up with drastic economic conditions.

These new expenses may leave many out of pocket but this tax time gives you the opportunity to claim a deduction relating to your work.

Bilias and Associates (Accountants and Advisers) Business Director, James Bilias says that he and his staff are currently “inundated with work”.

“On average I’ve been probably finishing at about 10 o’clock, or 10:30 every night. So most of the last couple of weeks has been trying to keep up with these new changes,” he says.

The greatest issue for accountants and advisers is keeping up to date with constant changes from the Australian Taxation Office.

Mr Bilias says, “We’re getting updates every day on what’s happening and changes. So what I advised last week won’t be the same as this week. To be honest I think they’re making it easier with what’s happening, but the information availability is very grey at the moment. The certainty of what you’re doing is not 100 percent most of the time.”

The biggest question he is getting is of course “what am I entitled to?”

“We often hear the words that ‘a friend said I can claim these expenses’. We are having to advise and educate them that not everyone is entitled to certain claims. It’s okay to ask the question though,” says Mr Bilias.

What to look out for

Mr Bilias says that people should be preparing and updating the information they require for the tax return before 30 June 2020.

Planning ensures you will maximise your eligible claims and obtain a better refund.

This also gives you the time to make sure the information you lodge is accurate, the more detail you have the better!

Mr Bilias says, “What we noticed is that individuals are also working longer hours from home without having dedicated traditional work hours. For many as a result of COVID 19 these claims are new to them.”

It is important to set up daily diary entries or time sheets recording your work hours and have a folder handy for work related expenses. If you are not sure put it aside and ask an accountant.

Now is the the best time to make best friends with your tax accountant.

For individuals

Individuals claiming their deductibles this year have three options to choose from; the shortcut method, the fixed rate method and the actual cost method.

Individuals have the ability to claim for expenses they incur when working from home, that they would otherwise not have expended.

This includes:

- Electricity expenses associated with heating, cooling and lighting the area from which you are working and running items you are using for work

- Cleaning costs for a dedicated work area

- Phone and internet expenses

- Computer consumables (eg printer paper and ink) and stationery

- Home office equipment including: computers, printers, phones, furniture and furnishings

You can claim either the

– Full cost of items up to $300

– Decline in value for items over $300.

For business owners

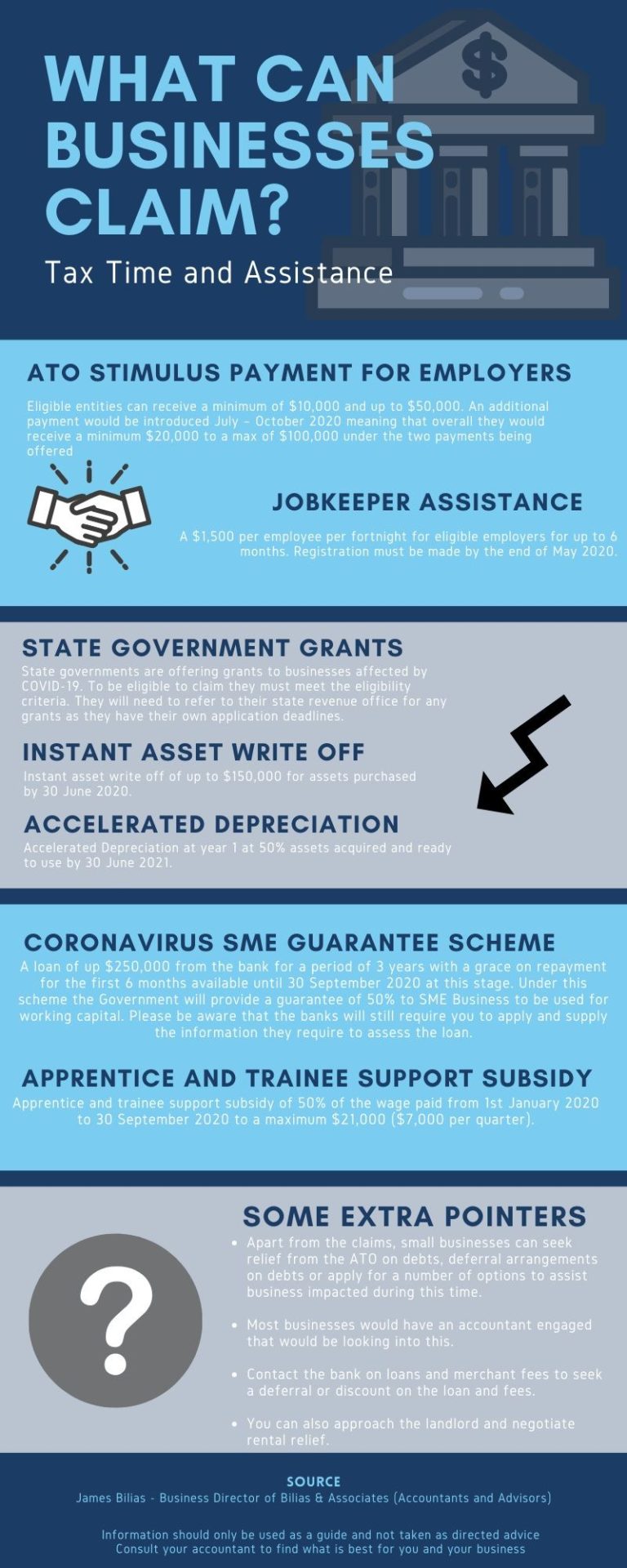

There are a range of options for businesses who may need some extra assistance this financial year, from stimulus payments to a trainee support subsidy.

READ MORE: Coronavirus support packages will reshape the future economy

For more information visit www.ato.gov.au or contact an accountant