At least 12 Greek Australians were included in The Australian‘s rich list naming the 250 wealthiest Australians in 2023.

The list includes a number of the most well known and influential self-made entrepreneurs in the nation but also, a number of relative “unknowns” among the general public.

They are the mining magnates, property pioneers, retail royalty, manufacturing moguls and technology titans who’ve made their mark on Australian commerce and society as a whole.

In first place out of the 250 is Gina Rinehart, executive chair of Hancock Prospecting with a net worth of $37.1 billion; up from $32.64bn the previous year.

Second is Andrew Forrest, executive chair of the Fortescue Metals Group with $35.21bn in the coffers up from $31.77bn in 2022.

Owner of Pratt Industries and executive chair of Visy, Anthony Pratt and family, came in at number three $27.87bn, a modest increase from last year’s $27.77bn.

Harry Triguboff, founder and owner of property development and construction firm Meriton came in fourth with $23.6bn up from $20.81bn.

And Clive Palmer took the fifth spot with a fortune of $20.4bn up from $18.25bn.

Australia is now home to 139 billionaires, a record according to the Herald Sun, including 31 women, their combined total wealth has now hit a staggering $531.96bn; another record.

A few Greek Australian business identities are among the newest additions to the ‘club’.

Terry and Arthur Tzaneros of container logisgtics operator, ACFS Port Logistics, can boast a combined worth of $1.56bn.

‘Petrol king’ Nick Andrianakos also joined the list with a net worth of some $1.3bn, as did founder, chair and CEO of Arrotex Pharmaceuticals Dennis Bastas sporting a cool $1.23bn.

Find below a more detailed list of this year’s richest Greek Australians and their respective positions in the top 250 according to The Australian.

58. Nick Politis, owner of WFM Motors and director of AP Eagers, $2.2bn (up from $2.18bn). Headquarters: NSW

Few people have sold as many cars as Mr Politis, and few have as much influence in rugby league.

His love of both combined in 1976 when he became the league’s first shirt sponsor, his City Ford dealership sponsoring his favorite team, the Eastern Suburbs Roosters (now Sydney Roosters).

Now serving as the club’s chair, Mr Politis’ wealth is derived from his car dealtherships, through his private company WFM Motors and the ASX-listed AP Eagers, of which he’s a major shareholder.

Having emigrated to Australia from Greece in the 1950’s Mr Politis lived in Queensland before working for Ford until finally going into business for himself.

87 & 86. Arthur Tzaneros & Terry Tzaneros, co-owners of ACFS Logistics & AGS World Transport, $1.56bn (up from $972mn). Headquarters: NSW

The Tzaneros family owns Australia’s largest privstely owned container logistics operator, ACFS Port Logistics.

With an annual revenue of more than $300mn, the company brings in around $85mn in earnings before taxes and depreciation.

The father-son team started the business which today employs more than 1,000 staff across Australia in 2005.

The Tzaneros family also owns AGS World Transport, a provider of freight services founded in 1985.

102. Nick Andrianakos & family, founder of Milemaker Petroleum & Nikos Property, $1.3bn (up from $896mn). Headquarters: Victoria

Having made his fortune in the oil industry, Mr Adrianakos and his family have diversified their portfolio through a series of moves into real estate in recent years.

Last year acquiring 50 per cent of the Colonnades shopping centre in Adelaide for $135mn, the family business also owns office buildings in Melbourne, Brisbane and Adelaide; helmed by son Theo Andrianakos as group-wide CEO.

Arriving in Melbourne from Greece in 1966, Nick Andrianakos bought his first petrol station in 1973, going on to build the Milemaker chain from the ground up, which he sold to Caltex in 2016 to the tune of $94mn.

110. Dennis Bastas, chairman and CEO of Arrotex Pharmaceuticals, $1.23bn (up from $974bn). Headquarters: Victoria

The son of Greek migrants who arrived in Australia in the early 1960’s; Mr Bastas worked in logistics at Coles Myer and then Village Roadshow before making the move to generic pharmaceuticals.

Arrotex currently produces about one third of the medications which full under the purview of the Pharmaceutical Benefits Scheme.

Bastas also serves as the chair of Juno Pharmaceuticals controlling a 50 per cent stake in the company, which supplies hospitals with drugs used in oncology and surgery; he also owns a stake in the genomics company My DNA.

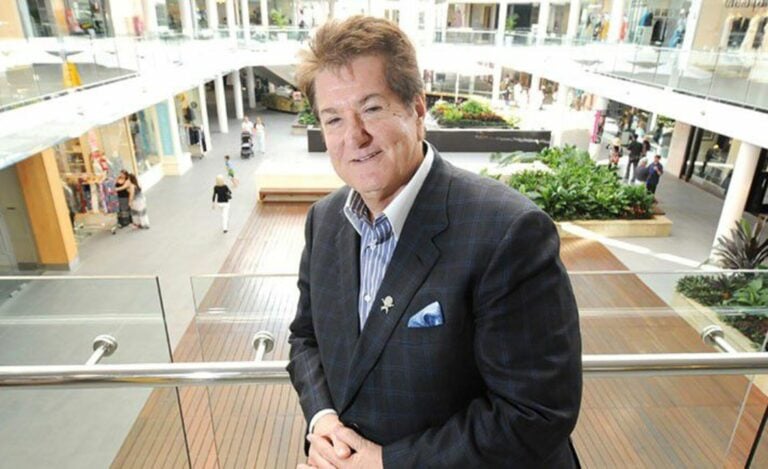

114. Theo Karedis & family, co-founder of Theo’s Liquor & Arkadia Property Group, $1.16bn (from $1.14bn). Headquarters: NSW

Now more than two decades on from Mr Karedis’ sale of the family’s Theo’s Liquor chain to Coles in a deal worth around $200mn, their wealth now resides in investment firm Arkadia.

With 25 retail and commercial properties across Australia, its holdings are primarily large-scale malls specializing in retail tenancies.

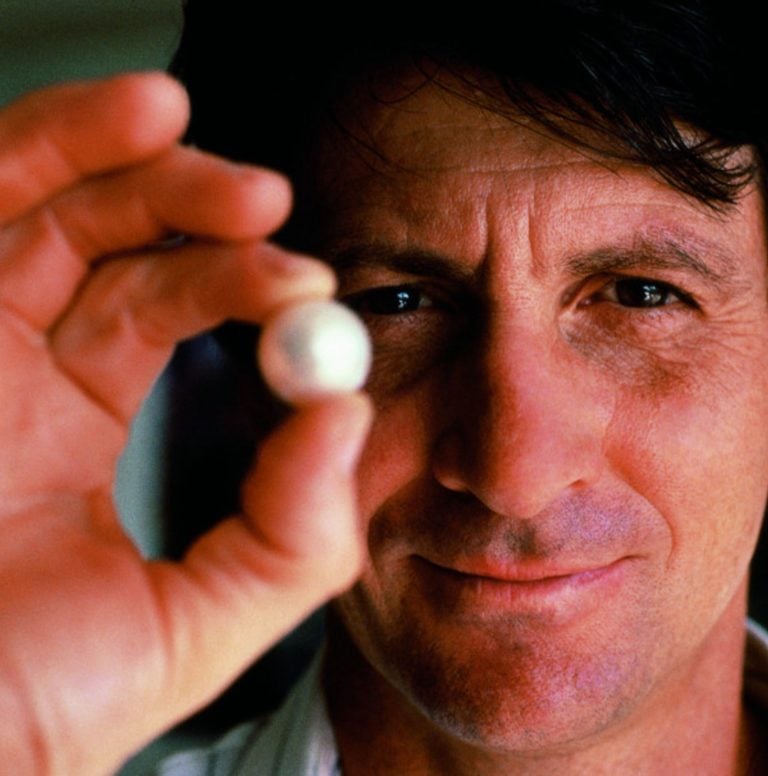

120. Nicholas Paspaley & family, executive chairman of Paspaley Group, $1.12bn (up from $1.09bn). Headquarters: NSW

A name synonymous with pearls in Australia, Paspaley Group’s roots in the pearling industry date back to Nicholas Paspaley Sr.’s diving expeditions off the remote shores of Western Australia following his arrival from Greece in 1919.

Today, the business overseen by his son entails interests across the pearling, aviation, retail, livestock, winemaking and commercial property industries among others.

The Group’s pearling business employs about half of its 1,200 total employees, accounting for approximately 40 per cent of the firm’s annual revenue.

Last year the family opened the luxury Wall Street Hotel in New York City, it also hold a number of luxury apartment rentals in Aspen, Colorado.

162. Spiros Alysandratos, founder of Consolidated Travel, $850mn (up from $769mn). Headquarters: Victoria

After starting Consolidated Travel in 1967, Mr Alysandratos’ business soon became one of the largest organisations in the travel industry.

Facilitating ticketing requirements for travel agents on behalf of more than 250 airlines worldwide, Consolidated Travel is Australia’s largest private provider of aviation products and services.

Alysandratos’ investment portfolio also includes several commercial buildings in Melbourne’s CBD.

167. Con Makris & family, chairman of Makris Group, $813mn. Headquarters: Queensland

Makris Group’s assets include the Marina Pier in Glenelg, Adelaide and the Oracle Boulevard dining and shopping precinct on the Gold Coast.

Having added the Marina Mirage to its Queensland holdings, the Makris Group recently announced its plans for a $500 million makeover of the location, which includes a hotel, retail and dining spaces as well as waterfront residences.

Mr Makris emigrated to Australia from Greece at the age of 16. His start came in the form of a series of real estate acquisitions while operating a number of takeaway chicken shops.

Eventually adding a list of shopping centres, such as Melbourne’s Endeavor Hills to the roster, Makris Group’s holdings expanded beyond the borders of South Australia in short order.

172. Harry Stamoulis & family, director of Stamoulis Property Group, $767mn (up from $752mn). Headquarters: Victoria

Headquartered in Victoria, the growth of the Stamoulis family fortune traces back to the Gold Medal drinks business founded by the late Spiros Stamoulis in 1969.

With the profits of that venture strategically invested in real estate over the years, Gold Medal was sold to Cadbury Schweppes in 2004.

Harry now oversees the family’s investments comprising office buildings and industrial properties, as well as a number of Gold Coast properties earmarked for multi-family housing.

189. Kerry Harmanis, founder of Jubilee Mines, $683mn (up from $673mn in 2022). Headquarters: Western Australia

Formerly a lawyer, Mr Harmanis forged his forture from the sale of Jubilee Mines to Anglo-Swiss multinational Xstrata for $3.1bn in 2007.

Since then he’s reportedly kept a low profile, investing in several emergent mining firms. Namely precious metal exploration company Talisman Mining, for which he serves as chair.

226. Ilias Pavlopoulos, co-founder of ColCap, $570mn (jointly with Andrew Chepul). Headquarters: NSW

Mr Pavlopoulos and Mr Chepul reportedly helm one of the country’s largest non-bank lenders. Founded in 2006, ColCap has a loan portfolio to the tune of more than $12 billion, employing over 260 people across Australia, the UK and the Philippines.

The group includes Origin Mortgage Management Services, Homestar Finance and Granite Home Loans; recording net profits in the area of $60mn according to regulatory filings.

As a “dedicated philanthropist” he also founded Mindful Meditation Australia, providing education services to teachers aimed at helping them incorporate meditative and mindfulness practice in the classroom.